Despite improved confidence throughout both November and December, GfK’s latest study has revealed a drop in all measures of consumer confidence in January. The results, which will leave brands feeling unsettled as they continue through Q1, sheds light on a particularly dire view of the broader UK economy. This gloomy outlook has also driven a significant climb in consumer’s motivation to save, which will have a direct impact on what they’re spending with brands.

The level of confidence consumers have in their personal financial stability and the broader economic situation can sway how much they spend with brands. This is as consumers who lack confidence will typically purchase fewer products or services whilst also requiring more ‘nudging’ and greater discounting before they part with their cash.

Key takeaways from the study:

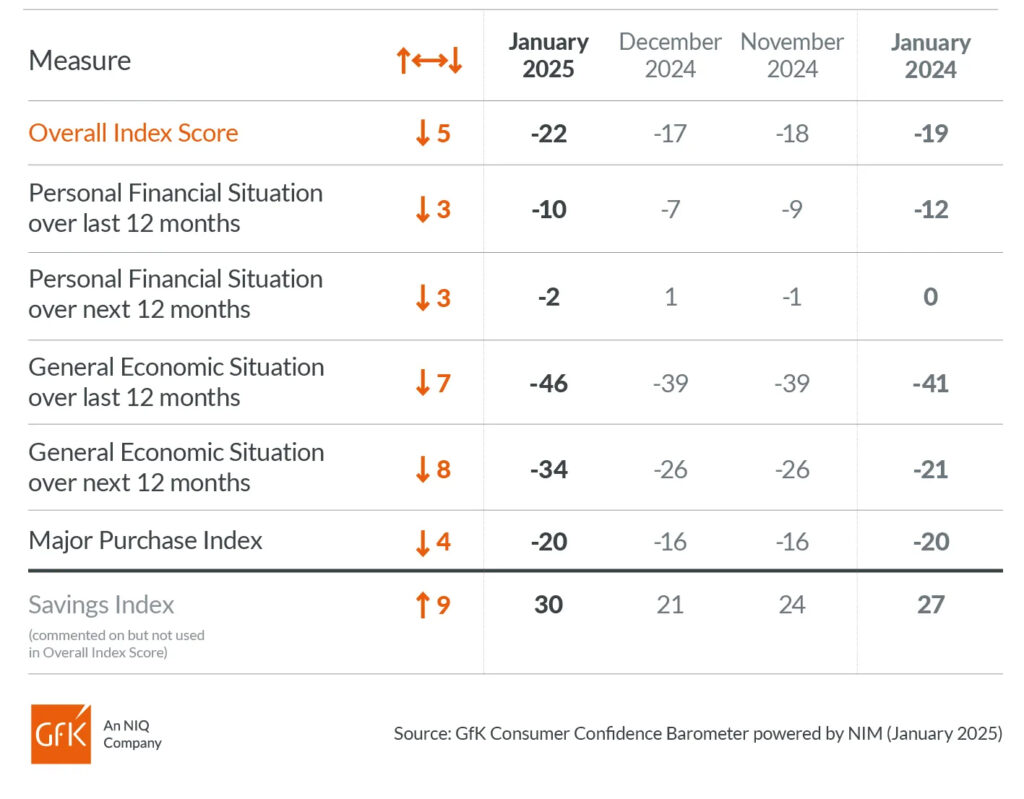

- Overall consumer confidence dropped by 5-points to -22. As well as being 3-points below that reported in January of last year, it bucks the trend of improving confidence at the end of 2024.

- Consumer’s view of the wider economic situation has taken the biggest hit. The study revealed a 7-point drop in their view of the prior 12 months and 8-point fall in their view of the coming 12 months.

- Despite a gloomy outlook of the wider economy, consumer’s confidence in their personal financial situation fell by a lesser extent. Their confidence in their personal finances over the past and next 12 months both dropped by 3-points.

- The savings index, which measures consumer’s motivation to save, climbed by 9-points. This places this measure 3-points above that seen in January of last year.

The impact on brands:

- Whilst both November and December’s results allowed brands to take a sigh of relief, GfK’s latest study demonstrates the brittleness of consumer confidence at this time. Brands who witnessed relatively good performance in the run up to Christmas may find that this fails to continue throughout January.

- The study may indicate that talk of a weak pound, mounting government debt, and a lack of economic growth has motivated a greater number of consumers to begin pocketing cash. With consumers choosing to save for ‘rainy days’, brands will need to work harder to win them as customers.

- Following the high expenditure of December and greater gap between paydays in January, it’s typical for consumers to feel strained in the new year. But the year-on-year decline and particularly harsh view of the wider economy suggests the concern is about factors out of their control rather than personal finances.

Whilst delving into a single month’s worth of data offers limited insight, analysing several months can indicate the challenges brands will face in the months ahead. We will continue to publish further articles when updates of the GfK Consumer Confidence Barometer are made available.